Agassi company uses a job order – Agassi Company employs a job order costing system, a crucial tool for managing costs and optimizing operations in an environment where unique products are manufactured based on specific customer orders. This system provides accurate costing of individual jobs, enabling better cost control and informed decision-making, while also presenting challenges in terms of complexity and time consumption.

Job order costing plays a pivotal role in various industries, including construction, engineering, and printing, where each project or order is distinct and requires meticulous tracking of costs. Agassi Company, renowned for its commitment to precision and efficiency, has successfully implemented a job order costing system tailored to its specific business needs, ensuring accurate cost allocation and enhanced profitability.

Job Order Costing System Overview

Job order costing is a cost accounting system designed for businesses that produce unique products or services for each customer. It is a method of assigning costs to specific jobs or orders, providing detailed information about the costs associated with each project.

This system is particularly relevant to Agassi Company, as it manufactures custom-designed furniture for its clients.

Key features and benefits of using a job order costing system include:

- Accurate costing of individual jobs or orders

- Identification of cost overruns or inefficiencies

- Improved decision-making regarding pricing and production

- Enhanced profitability through better cost control

Industries or businesses that typically use job order costing include:

- Construction

- Manufacturing

- Printing

- Engineering

Steps in Job Order Costing

Job order costing is a method of assigning costs to specific jobs or batches of production. This method is used when each job or batch is unique and requires its own set of costs to be tracked.

The steps involved in job order costing include:

Receiving and recording direct materials

The first step in job order costing is to receive and record the direct materials used in the job. Direct materials are those materials that can be directly traced to the job. For example, the wood used to make a table would be considered a direct material.

Assigning direct labor costs

The next step is to assign direct labor costs to the job. Direct labor costs are those costs that can be directly traced to the job. For example, the wages paid to the carpenter who made the table would be considered direct labor costs.

Applying manufacturing overhead

The third step is to apply manufacturing overhead to the job. Manufacturing overhead is a term used to describe all of the indirect costs of production. These costs cannot be directly traced to a specific job, but they are necessary for the production process.

Agassi Company uses a job order costing system. The company’s medicare participant, Joe , is responsible for ensuring that all job orders are completed accurately and on time. Agassi Company relies on Joe’s expertise to ensure that the company’s job order costing system runs smoothly.

For example, the cost of rent for the factory would be considered manufacturing overhead.

Calculating unit costs

The final step in job order costing is to calculate the unit cost of the job. The unit cost is the total cost of the job divided by the number of units produced. For example, if the total cost of making a table is $100 and 10 tables are produced, the unit cost would be $10.

Direct Materials and Labor Costs

Agassi Company identifies and records direct materials and labor costs meticulously to ensure accurate job costing. These costs are essential elements in determining the total cost of each job order.

Direct materials are the raw materials and components that can be directly traced to a specific job order. They include materials such as fabric, leather, or wood. Agassi Company uses a perpetual inventory system to track direct materials inventory levels and assigns costs to job orders based on the materials requisitioned for each job.

Assigning Direct Materials Costs

Agassi Company uses a job cost sheet to track the costs associated with each job order. When direct materials are issued from the inventory for a specific job order, the cost of those materials is recorded on the job cost sheet.

This allows the company to accumulate the total direct materials cost for each job.

Direct Labor Costs

Direct labor costs represent the wages and benefits paid to employees who work directly on a specific job order. These costs include the time spent cutting, sewing, or assembling the product. Agassi Company uses a timekeeping system to track the hours worked by each employee on each job order.

Assigning Direct Labor Costs

The direct labor costs are assigned to job orders based on the time cards submitted by employees. The hourly wage rate of each employee is multiplied by the number of hours worked on a specific job order to determine the direct labor cost for that job.

Examples of Direct Materials and Labor Costs

- Direct Materials: Fabric, leather, wood, zippers, buttons

- Direct Labor: Cutting, sewing, assembling, finishing

Manufacturing Overhead Allocation

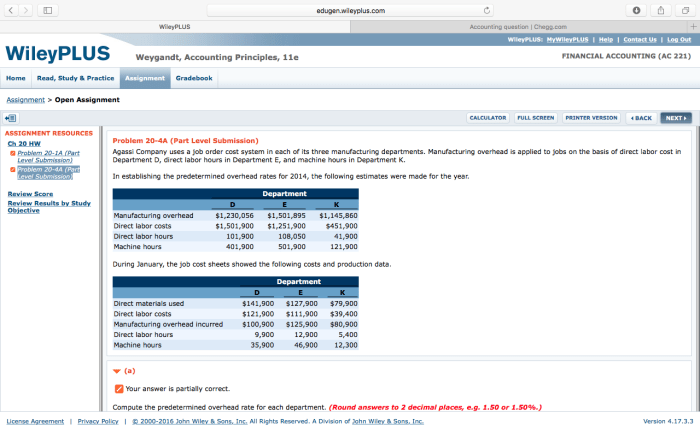

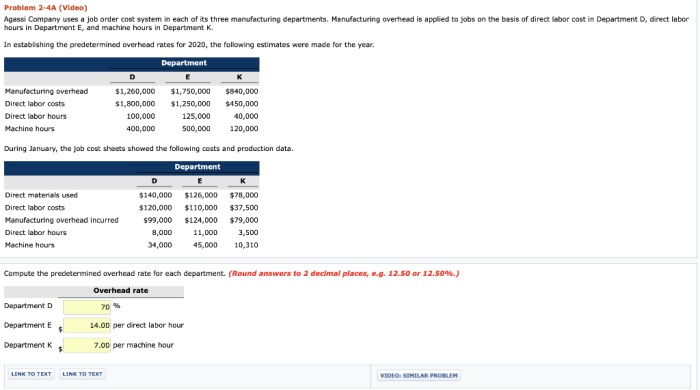

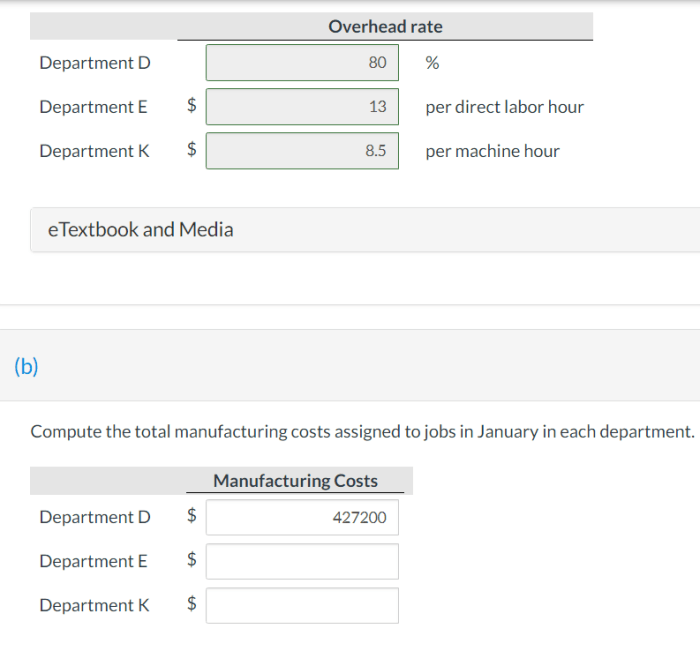

Manufacturing overhead refers to indirect costs incurred during production that cannot be directly traced to specific job orders. Allocating these costs to job orders is crucial for accurate product costing and pricing.

There are several methods for allocating overhead costs, including:

Direct Costing

- Direct overhead costs can be directly attributed to a specific job order, such as setup costs or inspection costs.

Indirect Costing

- Indirect overhead costs are not easily traced to a specific job order and are allocated based on a predetermined rate. Examples include rent, utilities, and depreciation.

Activity-Based Costing (ABC)

- ABC assigns overhead costs based on the activities performed during production. This method is more accurate but also more complex to implement.

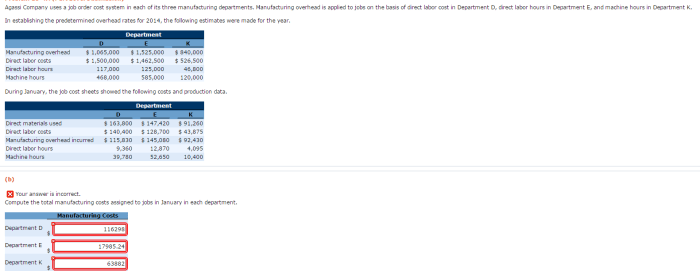

Agassi Company incurs various overhead costs, including:

- Factory rent

- Depreciation on factory equipment

- Utilities

- Factory supplies

These costs are allocated to job orders using a predetermined overhead rate based on direct labor hours or machine hours.

Job Cost Sheets and Work in Process Inventory

Job cost sheets are essential tools for tracking costs associated with specific jobs or orders. They provide a detailed record of all costs incurred during production, including direct materials, direct labor, and manufacturing overhead.

Each job cost sheet is assigned to a specific job or order and serves as a record of all costs associated with that job. Job cost sheets are used to calculate the total cost of each job and to track the flow of costs through the work in process inventory account.

Recording Job Costs

Job costs are recorded on job cost sheets as they are incurred. Direct materials costs are recorded when materials are issued to production. Direct labor costs are recorded when employees work on the job. Manufacturing overhead costs are allocated to jobs based on a predetermined overhead rate.

Work in Process Inventory, Agassi company uses a job order

The work in process inventory account is used to track the costs of jobs that are in production but not yet completed. As job costs are incurred, they are debited to the work in process inventory account. When a job is completed, the costs are transferred from the work in process inventory account to the finished goods inventory account.

Example of a Job Cost Sheet

The following is an example of a job cost sheet for Agassi Company:

| Job Cost Sheet | |

|---|---|

| Job Number: | 12345 |

| Customer: | ABC Company |

| Description: | 100 widgets |

| Costs | |

| Direct Materials: | $100 |

| Direct Labor: | $200 |

| Manufacturing Overhead: | $50 |

| Total Cost: | $350 |

Completed Job Costs and Cost of Goods Sold

Once a job is completed, its costs must be transferred to the finished goods inventory. This process involves making accounting entries to record the transfer and update the cost of goods sold.

Transfer of Completed Job Costs

When a job is completed, its total cost (direct materials, direct labor, and manufacturing overhead) is transferred from the work in process inventory account to the finished goods inventory account.

Accounting Entry:

- Debit: Finished Goods Inventory

- Credit: Work in Process Inventory

Impact on Cost of Goods Sold

The cost of goods sold is the total cost of the goods sold during a period. When completed job costs are transferred to finished goods inventory, they increase the cost of goods sold for the period.

Accounting Entry:

- Debit: Cost of Goods Sold

- Credit: Finished Goods Inventory

Advantages and Disadvantages of Job Order Costing

Job order costing is a costing method used to track the costs associated with specific jobs or projects. It is often used in industries where products are manufactured to customer specifications, such as construction, engineering, and shipbuilding.

Advantages of Job Order Costing

There are several advantages to using a job order costing system:

- Accurate costing of individual jobs:Job order costing allows companies to accurately determine the cost of each job, which is essential for pricing and profitability analysis.

- Improved cost control:By tracking costs at the job level, companies can identify areas where costs can be reduced.

- Enhanced decision-making:Job order costing provides valuable information that can be used to make informed decisions about pricing, production, and marketing.

Disadvantages of Job Order Costing

However, there are also some disadvantages to using a job order costing system:

- Complexity and time-consuming:Job order costing can be a complex and time-consuming process, especially for companies that produce a large number of different products.

- Potential for errors:The complexity of job order costing can lead to errors, which can have a significant impact on the accuracy of the cost data.

Case Study: Agassi Company’s Job Order Costing System: Agassi Company Uses A Job Order

Agassi Company is a manufacturer of high-end furniture. The company uses a job order costing system to track the costs of each individual job, or order, that it produces. This system allows Agassi Company to accurately determine the cost of each job and to set prices that will generate a profit.

Agassi Company’s job order costing system is based on the following steps:

- When a new job is received, a job cost sheet is created. The job cost sheet includes information about the customer, the job specifications, and the estimated cost of the job.

- As the job progresses, the actual costs of direct materials, direct labor, and manufacturing overhead are recorded on the job cost sheet.

- When the job is completed, the actual costs are compared to the estimated costs. Any variances are investigated and corrected.

- The completed job cost sheet is used to determine the cost of the job and to set a price for the job.

Agassi Company has experienced a number of challenges and successes with its job order costing system.

Challenges

- One challenge is the complexity of the system. Job order costing requires a great deal of paperwork and record-keeping. This can be a burden for small businesses with limited resources.

- Another challenge is the difficulty in estimating the cost of a job. Many factors can affect the cost of a job, such as the availability of materials, the complexity of the job, and the efficiency of the workforce. This can make it difficult to set accurate prices for jobs.

Successes

- Despite these challenges, Agassi Company has experienced a number of successes with its job order costing system. One success is the ability to accurately track the costs of each job. This information allows Agassi Company to make informed decisions about pricing and production.

- Another success is the ability to identify areas where costs can be reduced. By analyzing the job cost sheets, Agassi Company can identify areas where costs are higher than expected. This information can then be used to make changes to the production process or to negotiate better prices with suppliers.

Overall, Agassi Company’s job order costing system has been a valuable tool for the company. The system has helped Agassi Company to accurately track the costs of each job, to set prices that generate a profit, and to identify areas where costs can be reduced.

FAQ Section

What are the key benefits of job order costing?

Job order costing provides accurate costing of individual jobs, facilitates improved cost control, and supports informed decision-making.

How does Agassi Company identify and record direct materials and labor costs?

Agassi Company utilizes a robust system to identify and record direct materials and labor costs, ensuring accurate allocation of these costs to specific job orders.

What methods does Agassi Company employ to allocate manufacturing overhead costs?

Agassi Company leverages a combination of direct, indirect, and activity-based costing methods to allocate manufacturing overhead costs, ensuring equitable distribution of these costs across job orders.