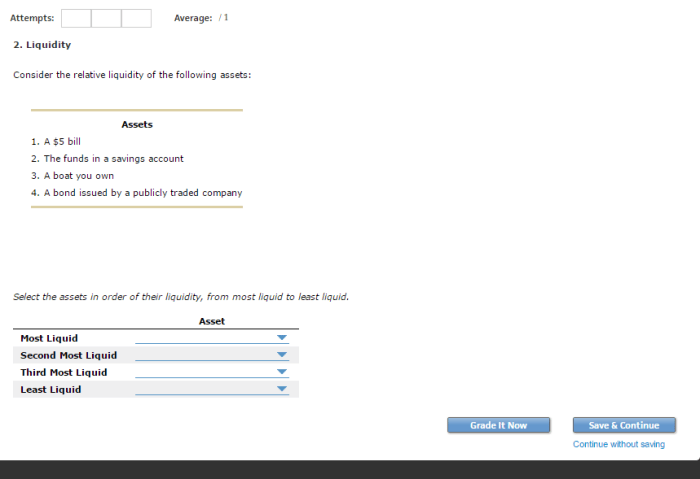

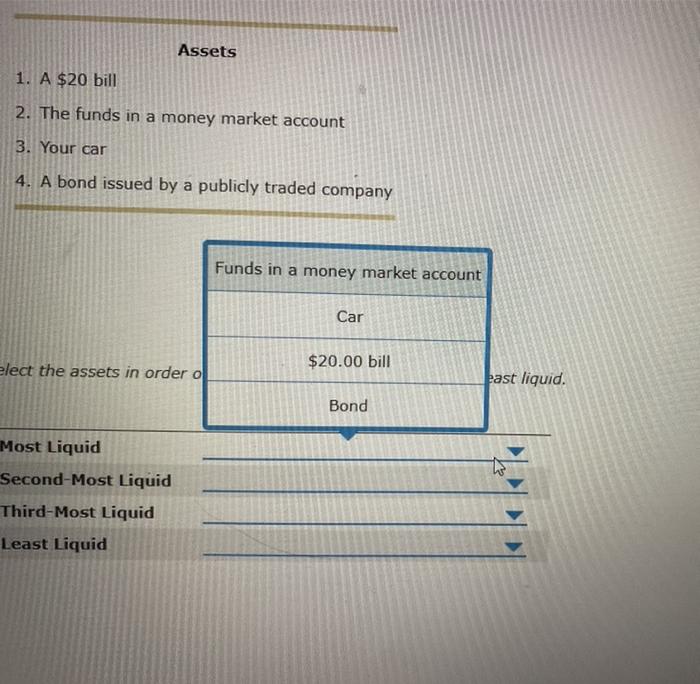

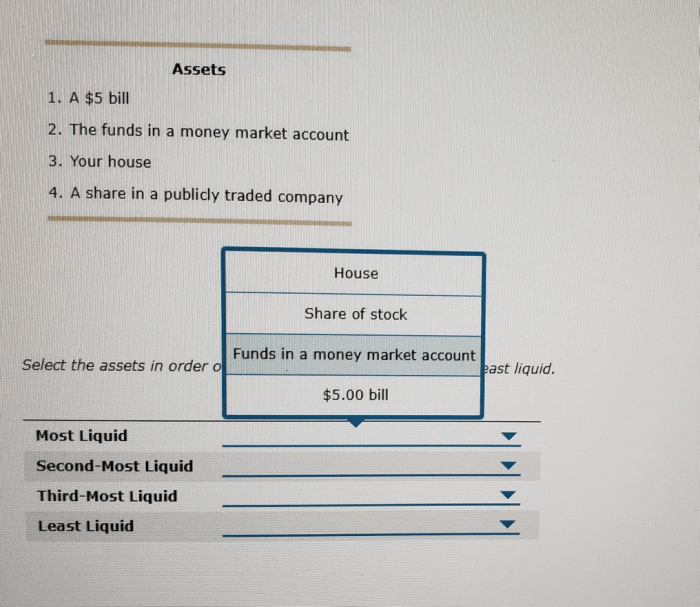

In the realm of asset management, liquidity stands as a crucial factor, shaping investment strategies and influencing financial outcomes. Consider the relative liquidity of the following assets, as it unveils the dynamic nature of liquidity and its impact on the investment landscape.

Liquidity, defined as the ease with which an asset can be converted into cash without significant price impact, plays a pivotal role in managing risk, optimizing returns, and achieving financial goals. Understanding the relative liquidity of different asset classes empowers investors to make informed decisions and navigate the complexities of the financial markets.

Factors Affecting Liquidity: Consider The Relative Liquidity Of The Following Assets

The liquidity of an asset is influenced by several key factors, including:

Market Depth

Market depth refers to the number of buyers and sellers willing to trade an asset at a given price. A deep market indicates a large pool of potential counterparties, which enhances liquidity by facilitating the execution of trades quickly and efficiently.

Trading Volume, Consider the relative liquidity of the following assets

Trading volume measures the total amount of an asset that is bought and sold over a specific period. High trading volume suggests that there is active interest in the asset, which increases its liquidity as it makes it easier to find a counterparty for a trade.

Volatility

Volatility refers to the degree to which the price of an asset fluctuates over time. High volatility can reduce liquidity as investors may be hesitant to trade an asset that is subject to significant price swings.

Regulatory Constraints

Regulatory constraints, such as lock-up periods or trading restrictions, can limit the ability to trade an asset, thereby reducing its liquidity.

FAQ Corner

What are the key factors that influence asset liquidity?

Factors such as market depth, trading volume, volatility, and regulatory constraints significantly impact the liquidity of assets.

How can investors assess the relative liquidity of different assets?

Investors can employ methods such as bid-ask spreads, market impact costs, and turnover ratios to quantify liquidity and compare the relative liquidity of different assets.

How does asset liquidity impact investment strategies?

Asset liquidity considerations influence risk management strategies, return optimization techniques, and the overall alignment of investments with financial goals.